Elephants in the ERC Room…And a Flying Dumbo (Part 3)

David Celestra Tan, MSK

14 March 2019

Part 3 of 3

In addition to the skeletons in the ERC closets, there are elephants in their regulatory room, including a flying dumbo.

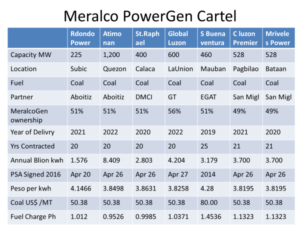

These are the seven (7) Meralco midnight contracts totaling 3,551mw that it negotiated under the name of project companies that turned out are all controlled by its sister company Meralco PowerGen. They are all waiting for ERC approval who in turn is waiting for the Supreme Court Decision on the issue of whether ERC had the legal right to postpone the effectivity date of the Competition Selection Policy from November 6, 2015 to April 30, 2016.

While the former ERC Commissioners were claiming that the extension (that they are calling “clarification”) were only intended to respond to the numerous requests from distribution utilities and power generators for their power supply contracts that were left hanging and could not make the November 6, 2015 ERC filing deadline, and that Meralco was not a consideration, it cannot be denied that the main beneficiary of the extension was Meralco, who just happened to be able to finalize 3,551mw of power supply with 5 partners within 40 days of extension announcement on March 15, 2016 on April 26, 2016 and was able to beat the new ERC filing deadline three days later or April 29, 2016. Neither can it be denied that Meralco’s 7 midnight contracts were not signed as of November 6, 2015.

Not convinced, consumer group Alyansa Para Sa Bagong Pilipinas (ABP), a group inspired by President Duterte’s call for changes for a new Philippines specially corruption, filed a complaint with the Office of the Ombudsman against the Commissioners for abuse of discretion and with the Supreme Court challenging the legality of the extension.

The Ombudsman suspended the ERC Commissioners for 90 days on the administrative case and filed a criminal case in the Pasig Court. The Supreme Court we understand had decided that this is a matter that will be elevated to an enbanc decision.

Meanwhile, the development of new power projects to meet future demand is at a standstill. The seven (7) midnight contracts are veritable elephants in the ERC room that will have to be decided soon.

1. The major power generators who have become part of the Meralco 6 (Meralco PowerGen, Aboitiz, EGAT of Thailand, San Miguel, Global Business, DMCI-Semirara) will not develop new projects in Luzon until these seven contracts are resolved. Who will be the off-takers anyway? And who would buy from them at the same negotiated prices without undergoing a CSP?

2. The other major power generators who have similarly established track records but did not get invited to the Meralco party, could not develop major projects because they are shut out of the Meralco market which is 70% of Luzon Grid. Now outsiders looking in are the Lopez Group, Ayala Power, KEPCO of Korea, Team of Japan, AES of USA. Seeing their lack of access to the Meralco market, AES had sold a significant share to Meralco partner EGAT of Thailand and expected to Exit from the Philippines, Ayala sold its shares in GNPower to Meralco partner Aboitiz Group, Global Business sold its majority to the MVP Group that controls Meralco. Energy World of Australia is still cooling their heels waiting for a PSA. The Philippines is not ripe for merchant plants given that the WESM is now artificially depressed by subsidized Renewable Energy resources.

3. Let us hope the Supreme Court decides soon one way or the other and not wait until there is a power crisis and a decision unfavorable to the consumers would meet less resistance from a power starving public. We predict anyway that the highest court of the land will rule that the ERC is within its authority to extend the CSP deadline legally but will not rule on whether it abused its authority. Having the legal authority is one thing. Abusing that authority is another.

4. Nonetheless, we can expect the ERC to move ahead and approve the seven contracts under the cloak of legality that the Supreme Court will provide. Whether it abused that authority the new commissioners might recognize and mitigate or the Ombudsman might determine and continue the criminal case.

5. Several things are working against the credibility of the old ERC’s contention that the extension was not intended to Benefit Meralco but to respond to those numerous generators and distribution utilities who needed more time to file the ERC application for their signed contracts.

a) The Ombudsman found out that as late as January 2016 Meralco was still petitioning to be allowed to hold a ‘swiss challenge” type bidding as their form of CSP clearly to give them procedural room to maneuver for the intended winners. The ERC denied the request but what happened in February and early March that motivated the ERC to extend the CSP deadline?

b) While there were 90 applicants who filed before the new April 30, 2016 deadline for approximately 4,000mw of power contracts, 3,551mw were from Meralco which is 88.75% of the total. And 350mw were between unrelated DU and power generators.

c) On the same day and session on March 15, 2016 that the ERC passed the resolution “clarifying” the deadline for CSP compliance, the ERC also “held in abeyance” a new rule in determining concentration of capacity limits as required by the EPIRA law to 30% of a regional grid and 25% of the national grid.

Why is suspending that rule significant and according to consumer group ABP a clear evidence that the ERC knew that Meralco would try to meet the new deadline with significant amount of contracts? The new rule adds an “ownership test” and an “operating tests” to the “control test” effectively closing the loophole that investors in “multi-owner” plants have been exploiting to avoid the ownership concentration limits of power generating capacity. The very rule that Meralco is evidently counting on in their unmitigated foray into power generation.

Under the old ERC formula, owners and operators of power plants can avoid the concentration limits as long as they don’t “control” the capacity which means appointing someone else to market or price the output as defined by Rule 11 of the Epira IRR.

Without removing this new formula that adds ownership and operating tests to the capacity concentration limits, Meralco would not have been able to consolidate their initial 4,011mw generating business under its sister company Meralco PowerGen. I am one of those who wanted to give the Commissioners the benefit of the doubt but the two resolutions passed on the same day and session both point to a Meralco benefit.

The MVP group as owners of Meralco is theoretically allowed under Section 45 of the EPIRA to own, operate, and control up to 50% of the demand and energy needs of Meralco. That means about 3,000mw by 2022. Clearly their ambitions are beyond that. By partnering with those who are willing to be their minority partners in exchange for access to the huge 6,000mw Meralco market, their power generating portfolio can be unlimited as long as they don’t “control” the capacity.

Notice that no one builds a major power project without either Meralco or Aboitiz as a partner?

6. Having said all these, it is one thing for the ERC to approve the Meralco seven (7) midnight contracts and another to assure that the rates are fair and reasonable. The ERC could only base their assessment on table and WACC evaluation and for political reasons can shave off a token reduction of P0.25 per kwh “to protect the public”, which can go the other way and be unfair to those with truly fair and reasonable applied for rates.

That is the problem with negotiated contracts. There is just no way to know what is fair and reasonable. Only a truly competitive bidding can determine that with benchmarking safeguards.

In the past we had compared a negotiated contract and a competitive one and the difference was anywhere from P0.50 to P1.00 per kwh. A Coop Group in the Visayas said the difference was P1.00 per kwh.

At the contracted 28 billion kwh a year, that is an overprice of anywhere from P14 billion to P28 billion a year to the Meralco consumers.

7. The new ERC Commissioners are caught between a rock and a hard place.

Lawyers we asked said that the new for Commissioners can be liable for abuse of discretion if they go ahead and approve the questionable contracts even if they were not the ones who extended the CSP deadline. There needs to be a legal mitigation, a compromise where the interest of the public is served and the violation of the law is addressed. Perhaps a curative CSP can be undertaken for 50% of the 3,551mw and the other half given up and tendered for Natural Gas plants. To be fair, each of the Meralco partners can give up half of what was allotted to them and they can still participate in a new open CSP that would be administered by a Third Party.

The ERC went out of the box by “clarifying” the date of the CSP. Meralco went out of the box for their doggoned determination to use their market power and secure negotiated contracts for Meralco PowerGen. The two had resulted to an impasse in power development that never happened before. We need an out of the Box solution.

The Department of Energy had issued to 1,200mw Atimonan One a Certificate of project of national significance in recognition of the need for more power in the future. Those they qualified were for permitting purposes. The evaluation of the fair and reasonableness of the rate is up to the ERC.

8. Power Crisis Gambit

Are we seeing a power crisis gambit in play here? The Supreme Court, Meralco, and ERC will just stand still and wait until there is a power crisis that can come as early as 2021. Then the power- starved consumers will be on their knees begging to be saved from brownouts and will not be able to care whether the CSP law was violated and their rates are high. Just give me power please!

These are the seven (7) elephants in the ERC’s room. Do they wait until the right power crisis time and perpetuate what Meralco wanted? Or do they proactively act now and engineer a compromise agreement that serves the public interest? How do they make sure the rates are fair and reasonable?

The Supreme Court is not doing anyone a favor by taking time on the decision. We hope they can decide one way or the other. The waiting is now part of the problem instead of the solution.

Meanwhile, one of the seven, a little Dumbo of 70mw had already flown away and been approved for a coal power plant in far away Iloilo that turned out is owned by the MVP Group through their acquisition of the Business Power Group of the Metrobank group. Ahh the power of self-dealing.

Matuwid na Singil sa Kuryente Consumer Alliance Inc.

matuwid.org

david.mskorg@yahoo.com.ph

2 Comments

Hi, may I share the correct list of 7 PSAs PSAs of Meralco :

1. 300MW Redondo Peninsula Energy Incorporated (for PSA 225 MW) – w/ MGen 47% & Aboitiz 25%

2. 2x600MW Atimonan One Energy Incorporated (PSA for1200 MW) – w/ MGen 100%

3. (2 x 350MW St Raphael Power Generation Corporation (for PSA of 400 MW) – with MGen 50% DMCI 50%

*4. 4x150MW Central Luzon Premiere Power Corporation (PSA is 528 MW) – with San Miguel – 4 x 150MW

*5. 4x150MW Mariveles Power Generation Corporation (528 MW PSA) – with San Miguel 49% MGen 49%

**6. Panay Energy Development Corporation (70 MW) – w/ GBPC (already built – existing plant)

7. 2x335MW Global Luzon Energy Development Corporation (600 MW)- w/ GBPC

* – no ECC yet

**- w/ provisional PSA already

FYI, below are the pending PSAs of Meralco which are awaiting ERC Approval:

Atimonan is 100%MGen

1. 300MW Redondo Peninsula Energy Incorporated (for PSA 225 MW) – w/ MGen 47% & Aboitiz 25%

2. 2x600MW Atimonan One Energy Incorporated (PSA for1200 MW) – w/ MGen 100%

3. (2 x 350MW St Raphael Power Generation Corporation (for PSA of 400 MW) – with MGen 50% DMCI 50%

*4. 4x150MW Central Luzon Premiere Power Corporation (PSA is 528 MW) – with San Miguel – 4 x 150MW

*5. 4x150MW Mariveles Power Generation Corporation (528 MW PSA) – with San Miguel 49% MGen 49%

**6. Panay Energy Development Corporation (70 MW) – w/ GBPC (already built)

7. 2x335MW Global Luzon Energy Development Corporation (600 MW)- w/ GBPC

* – no ECC yet

**- w/ provisional PSA already