ADB eyes direct financing of renewable energy projects in Philippine

By Louise Maureen Simeon – May 4, 2024 | 12:00am

from The Philippine Star

In an interview with The STAR here, ADB country director for the Philippines Pavit Ramachandran said RE is an area that the multilateral lender is excited about as it crafts the new CPS.

TBILISI — The Asian Development Bank (ADB) is looking at directly engaging with the Philippine government on financing renewable energy (RE) projects as part of its country partnership strategy (CPS) over the medium-term.

In an interview with The STAR here, ADB country director for the Philippines Pavit Ramachandran said RE is an area that the multilateral lender is excited about as it crafts the new CPS.

“It would be a relatively new sector from the sovereign public sector side because as you know, the Philippines is a largely privatized market,” Ramachandran said.

“But given the focus and the policy ambition to increase renewable energy, there’s a lot of other aspects in the sector that need to be also strengthened,” he said.

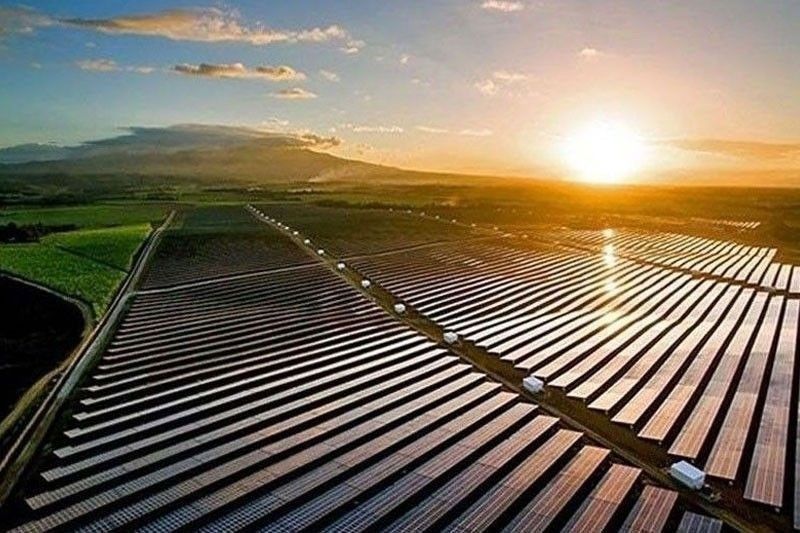

For now, ADB is doing work with the private sector in terms of RE through loan deals such as the P5.5-billion sustainability-linked loan with ACEN Corp. of the Ayala Group in December last year.

Just last week, ADB also inked a P675-million loan agreement with Buskowitz Solar Inc. for the installation of solar panel systems on commercial and industrial buildings’ rooftops in the Philippines.

However, Ramachandran said ADB has not directly engaged on the sovereign side.

“Transmission capacity needs to be enhanced. You need to have a lot of the associated infrastructure, for example, port development for offshore wind. There’s also a need for de-risking for sectors like geothermal,” Ramachandran said.

“So that’s something we are looking at in these different areas and what would be the appropriate modality and lending scope,” he said.

In the Philippines, the government has been pushing for the use of renewable and indigenous energy sources amid the need to bring down the country’s dependence on energy imports.

Data showed that only 29 percent of the country’s current energy mix comes from renewables. The Department of Energy would like to bring it up to 35 percent by 2030 or to 50 percent by 2040, as outlined in the RE roadmap.

Further, Ramachandran emphasized that human development is another area that ADB will prioritize in the CPS 2024-2029 for the Philippines to fully tap into its demographic potential.

This is in relation to the Philippines’ goal of securing an upper-middle-income status amid the need to secure human capital foundation through education, health and social protection.

Also, Ramachandran said ADB would further step up support for the Philippines to address the impacts of climate change as one of the core priorities of the Manila-based bank.

Another area of interest for ADB is agriculture amid several structural and policy challenges that hinder the growth potential of the sector.

“We are looking at other longer-term engagements as well. In Mindanao, we are looking at agro-enterprise development, irrigation projects and some work on port development including roll-on roll-off ports and fishing ports,” Ramachandran said.

“The value chain side of agriculture is very important to create jobs and reduce pre- and post-harvest losses. In terms of rural development, poverty reduction, export potential and more competitiveness, I think you can’t do it without agriculture,” he said.

Despite the new areas, Ramachandran maintained that a lot of investments would still be on the infrastructure side to support the flagship Build Better More program of the government.

ADB is still in the process of preparing the new CPS through consultations and analytical diagnostic work. It will be presented to the ADB Board in early August for approval.

The new CPS will cover 2024 to 2029, with the idea of overlapping it with the new administration by 2028.